‘Where did all my money go?’ is a question you, me and almost every other human being has asked. While at the beginning of every month we feel like the Queen of the world, by the start of the third week, we’re cringing looking at our bank statement. It’s like a spell – hocus pocus and I am brokus! Despite that, the minute someone starts talking to me about saving money, I take a deep breath and wish I had brought my earphones along. It’s just the curse of being a low-attention-span millennial, I guess!

Somehow, saving seems like an impossible task, right? We feel you. But here are a few minimum-effort-required things you can do to save your salary every month and avoid the broke-dom!

Also Read How to Negotiate Your Salary & Finally Get That Raise

1. Set aside a minimum amount right after you get your salary

First things first, don’t leave it till the end of the month, to put aside some money. Make sure you put a small amount aside right at the beginning. Make a separate bank account just for savings asking the bank to deduct a certain amount from your salary every month. Or just make sure you hand it to your mother. Even if it is a little amount, you will end up saving more than you think!

Here is a little bank (Rs 448) that will help you keep all that change safe too!

2. Record your expenses

It’s okay to go all out once in awhile, it really is! But when this becomes a habit, it basically leaves you with nothing. Record where you’re spending money and how you’re actually spending it so that you don’t get a heart attack at the end of the month looking at the bills!

And to make sure you’re penning down all your expenses right, get this cute little handmade diary (Rs 229)

3. Choose a purpose to save for

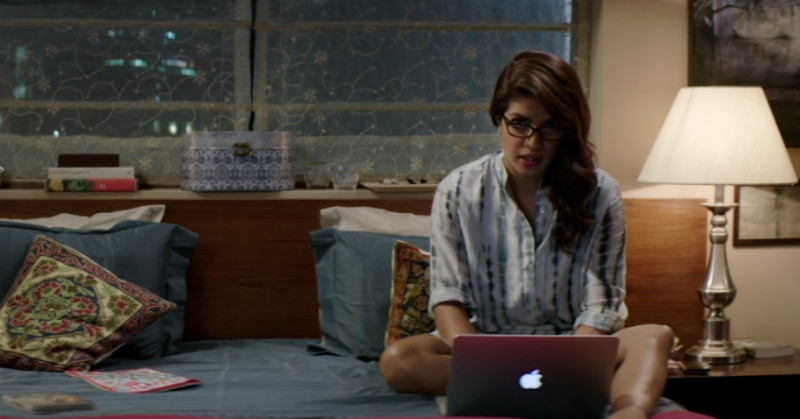

If you want some extra motivation to set aside money, define a goal for yourself. You could save up for a trip with your besties, or a MacBook or even the new iPhone X *drools*. Start with short term goals in the beginning and then slowly focus on more long term goals.

And incase you have already saved, now’s the time to buy the MacBook Air (Rs 55,490)!

4. Make a monthly budget

It’s good to have a monthly budget because that way, you’ll be able to keep a tab on your expenses and savings. Make sure you include all your luxuries and necessities in one so that you don’t make things unfair for yourself. In fact, you should have a Miscellaneous column in your budget for all those things you don’t need but want. Now just do your best to stay within the budget!

Shop these sticky note set (Rs 390) they will come in handy when you making your budget board!

5. Learn to use up ‘leftovers’

Okay, this is a really smart move. Hear me out, if you have a party coming up, recycle your old white shirt into a dress by wearing a trendy belt and awesome make up instead of buying a new dress. Similarly, last night’s leftover aloo sabzi can become next day’s grilled cheese aloo sandwich! Genius isn’t it? The more you spend on your everyday knick-knacks, the less you save. So remember: re-use, don’t waste!

Or just buy a jar of Nutella (Rs 312) to get yummy and easy breakfast every morning!

6. Invite friends over instead of going out

We all need a little break in life, that’s true. But going out on a regular basis may not be very easy on your pocket. The best way to go about this is to invite friends over to your place instead. And make it clear from the start that all expenses shall be shared. You will not only save more money but will also get to spend good quality time with your friends!

Get this amazing drinking Roulette set (Rs 1,299) now to make sure everyone has a great time!

7. Clean up your closet

There are so many things that are lying around in every person’s house that they barely use. Either you make sure you use them or simply sell them off online. (Take OLX pe bech de seriously, ladies!) Not only will you get rid of all the unwanted things from your house but will also earn a little money while you’re at it!

And before you start cleaning up your closet, buy these super cool earphones (Rs 549) to make you groove while you’re at it!

GIFs: Giphy

Read More From Self Help

Ananya Panday On Being Called ‘Chicken Legs’ and ‘Flat Chest’ In School & Why We Must Talk About It

Isha Jain

India’s Got Latent Contestant Jokes About Deepika Padukone’s Depression & Here’s Why It’s Not Okay

Isha Jain